Comprehensive IUX Review dedicated to traders from South Africa

IUX Review South Africa

Accepts South African Clients

Who is IUX?

IUX is an international CFD broker providing South African traders with access to over 230 different market instruments across various sectors. These include CFDs on forex currency pairs, stocks, commodities, indices, and cryptocurrencies. The broker provides its traders with three main trading platforms which include IUX App Trader, IUX Web Trader, and MT5.

The maximum leverage that traders have access to on this broker site is a competitively high 1:3000. With a small minimum deposit of just $10, traders can start to invest with this broker in South Africa.

IUX Group is Regulated by

FSCA

Financial Sector Conduct Authority, based in South Africa, license number 53103.

FSA

Financial Services Authority, based in St. Vincent and the Grenadines, registration number 26183 BC 2021.

ASIC

Australian Securities and Investments Commission, based in Australia, license number 529610.

FSC

Financial Services Commission, based in Mauritius, registration number GB22200605.

Risk warning: Remember that forex and CFDs available at IUX are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Pros

Cons

01

IUX.com Trading Assets

IUX boasts a comprehensive selection of over 250 CFD trading instruments, covering a broad spectrum of markets. The market products available to trade on this broker site include CFDs on forex currency pairs, stocks, commodities, indices, and cryptocurrencies. Below is a breakdown of the various market products on the IUX broker site:

- Forex - Forex traders can speculate on price movements of over 70 currency pairs, including major, minor, and exotic pairs.

- Indices - South Africans can trade popular indices such as US30, UK100, and GER30, among others.

- Stocks - This broker avails CFDs on stocks from major companies like Amazon and Alibaba.

- Commodities - Traders also have access to CFDs on soft and hard commodities like cocoa, coffee, and copper.

- Metals - IUX also gives its traders the opportunity to invest in precious metals like gold and silver.

- Cryptocurrencies - IUX also offers a variety of cryptocurrencies for traders to invest in. There are over 15 crypto pairs available including ETHUSD, LTCUSD, BTCUSD, BCHUSD, and BTCXAU.

Available Deposit & Withdrawal Methods

South African traders can use several payment options to deposit and withdraw funds, including:

Supported Platforms by IUX

IUX supports various trading platforms for both beginner and advanced traders:

IUX App Trader, IUX Web Trader

02

Trading Platforms of The Broker

IUX provides its traders with three main trading platforms tailored to different needs. First, the broker offers the IUX App Trader, enabling investors to trade on the go. The IUX App Trader offers seamless on-the-go trading with full customisation and rapid execution. Compatible with iOS and Android, this platform is user-friendly for both novices and seasoned traders.

For web-based trading, IUX offers the IUX Web Trader. This platform allows investors to execute trades without downloading any software. Built on the core of MT5, the platform provides a clutter-free environment with advanced charting tools for in-depth market analysis.

Finally, IUX offers the industry-standard MetaTrader 5 (MT5) platform, renowned for its comprehensive features and intuitive interface. Traders can access over 80 technical indicators, view up to 100 charts simultaneously, and utilize a range of pre-built tools for advanced analysis.

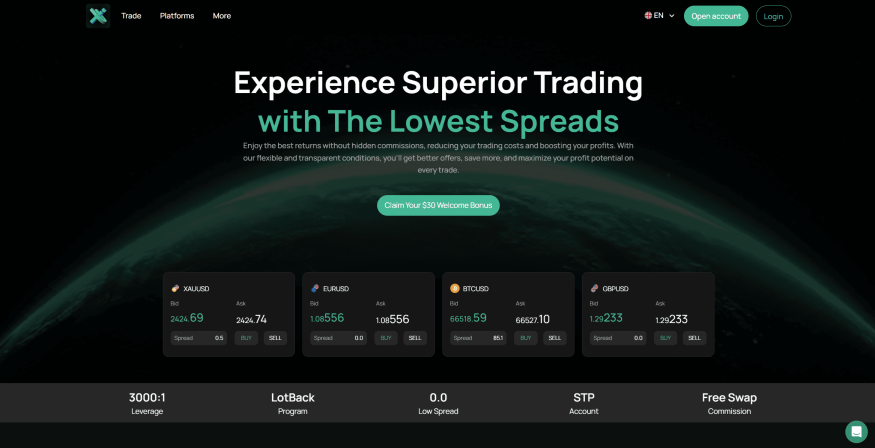

Screenshot taken from the official website of IUX.com

Did you know?

IUX offers a wide range of account types.

03

IUX Spreads and Fees

The costs associated with trading significantly impact a trader's overall experience. Traders often seek brokers with the lowest fees to maximize their earnings. IUX offers a variety of account types tailored to different trading styles and preferences. These include the Standard, Standard+, Raw, and Pro accounts, each with distinct fee structures.

The Standard account features spreads starting from 0.2 pips for major currencies, while the Standard+ account offers spreads from as low as 0.5 pips.

Both of these accounts do not charge a commission. The Pro account also offers commission-free trading and tighter spreads beginning at 0.1 pips. Finally, the Raw Spread account offers spreads from 0.0 pips but charges a commission of $3 per side per lot.

Additionally, traders incur a swap fee for holding positions overnight. This fee varies based on the asset and the trade size. However, IUX offers swap-free trading for those who primarily trade during the day.

04

IUX Education Section

The financial markets are constantly evolving, making continuous learning essential for traders of all levels. As such, brokers that offer educational resources are highly valued by traders of all experience levels.

Fortunately, IUX recognizes this and provides a comprehensive education section featuring articles, webinars, and an academy filled with lessons. These materials cover a wide range of topics, from basic to advanced concepts, across various markets.

For beginner traders, these resources are invaluable, helping them start their journey with informed minds and make sound decisions. Advanced traders can also benefit by learning new concepts, refining their skills, and improving their strategies.

Did you know?

IUX was established in 2016 and has Top-tier servers in London's LD4, New York’s NY4, Singapore’s SG4

ensuring smooth execution of your trades

06

IUX Customer Support

Reliable customer support is crucial for navigating the financial markets. IUX prioritizes its clients' needs by offering 24/7 support via email and phone. You can reach their support team at support@iux.com or call them at +35725247681. The only drawback is that IUX does not offer live chat support.

07

IUX.com Leverage Review

IUX.com offers to South African traders a high leverage of up to 1:3000, allowing traders to control large positions in the market. However, high leverage can amplify both profits and losses, so traders should use strict risk management techniques.

Interestingly, this broker sets the maximum leverage traders can enjoy for different market instruments when they open an account. The only exceptions to this are the indices and stock asset classes. For these two classes, the maximum leverage traders can enjoy depends on the liquidity providers.

IUX in head-to-head with South African leading competitors

Expert's cricital opinion

from the author of this IUX Review

IUX.com stands out for South African traders seeking an FSCA-regulated broker with competitive pricing. For starters, it offers a broad range of market instruments across different categories. Additionally, traders gain access to a comprehensive trading environment on the various platforms available.

However, to get a better understanding of how good the services of this broker are, we must compare it to some other top South African-based brokers. In this case, we will pin the broker against Exness and XM.

XM stands out as the broker with the most trading instruments among the three by a wide margin. XM avails over 1,000 different market products while IUX and Exness only provide just over 200 instruments. However, IUX and Exness fare better when it comes to the spreads involved. Specifically, IUX and Exness offer spreads from as low as 0.2 pips on their standard accounts while XM has spreads from 1.0 pips on its standard account.

Further, all three brokers offer a fairly low entry point for South African traders. XM has the lowest minimum deposit requirement among the three of just $5. In contrast, both Exness and IUX both have a minimum deposit of $10. However, South African traders may prefer Exness and XM over IUX as they support the ZAR as a base account currency.

Finally, all three brokers are regulated in multiple jurisdictions. Both IUX and Exness have regulations by the local South African regulator, FSCA. This license is most important for South African traders. However, IUX lacks regulations from a tier-one organisation like the CySEC which regulates both XM and Exness. Nonetheless, the ultimate choice comes down to each individual trader. Each trader must consider their personal trading goals and preferences before choosing a broker to trade with.

Peter Cook Ndungo

Editor, Senior Broker Analyst