Comprehensive Review dedicated to traders from South Africa

XTB Review South Africa

Accepts South African Clients

Who is XTB?

XTB is a leading international broker that supports speculation on 2200+ instruments and offer its own in-house built platform called xStation. The company is regulated by the local regulator FSCA in South Africa, by the FSC in Belize and by the prestigious FCA in the United Kingdom.

The XTB minimum deposit is only $1, which equals roughly to 18 ZAR.

XTB Group is Regulated by

FSCA

Financial Sector Conduct Authority, based in South Africa, license no 49970.

FSC

Financial Services Commission, based in Belize, license no 000302/438.

FCA

Financial Conduct Authority, based in the United Kingdom, license no 522157.

CySEC

Cyprus Securities and Exchange Commission, based in Cyprus, license no 169/12.

Risk warning: Remember that forex and CFDs available at XTB are leveraged products and can result in the loss of your entire capital.

Please ensure you fully understand the risks involved.

Pros

Cons

01

Trading assets

In total, there are over 1 500 trading instruments available at XTB to traders from SA. These include:

- Forex – Regarding forex pairs, there as of now 57 tradable pairs, you can find here major, minor as well as exotic pairs. Apart from the most popular currency pairs like EUR/USD, USD/JPY or GBP/USD, there are also 3 forex pairs with the South African Rand that can be traded against major currency pairs - EUR/ZAR, GBP/ZAR, USD/ZAR.

- Stocks (CFDs)– XTB offers stocks from 16 stock exchanges. In total there are 1 740 stocks that are composed of European, American, Australian and Asian stocks.

- Indices – XTB supports speculation on 42 indices. You can find here the world's most popular indices like UK100 or US500.

- Commodities – There are 23 commodities including gold, oil or coffee.

- Cryptocurrencies – It is possible to trade up to 25 cryptocurrency pairs (9 different cryptocurrencies that are tradable against the USD or other cryptocurrencies)

- ETFs (CFDs) – XTB allows speculation on 114 ETFs that comprise of the world's most popular titles like iShares, Lyxor, or Amundi.

South African traders can trade some of these instruments with up to 1:500 leverage.

Available Deposit & Withdrawal Methods

XTB supports the following deposits and withdrawal methods

Supported Platforms by XTB

XTB supports the following trading platforms

02

Trading platform of the broker

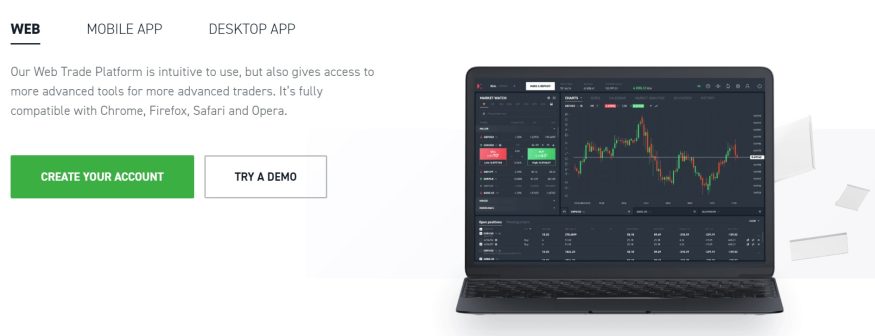

XTB offers an in-house built trading platform called xStation 5. The platform can be accesed directly via a web browser as it is it’s fully compatible with Google Chrome, Firefox, Safari and Opera or can be downloaded to any PC, mobile or tablet.

xStation 5 provides a clear, simple and intuitive trading environment packed with a comprehensive charting system. Additionally, directly in the platform you can find economic news calander as well as market news that will help you with analysing the current sentiment of the market.

Screenshot taken from the official website of XTB, page trading platforms

Did you know?

XTB is one of the largest stock exchange-listed FX & CFD brokers in the world with offices in over 13 countries.

03

Trading fees

XTB as any other forex/CFD broker charges spreads. They are fairly tight here, according to the account information page they start from 0.8 pips.

Some brokers also charge commission fees, these are not applicable at XTB when trading Forex, Indices and Commodities, they are only for Stock CFDs and ETF CFDs, for these instruments the commission fee starts at 0,08% per lot.

XTB does not charge fees for bank transfers and credit/debit card deposits. For Skrill and Netteller deposits there is a fee of 2% and 1% of your deposited amount, respectively.

Regarding withdrawals, there is a fee of 1,5% for card withdrawals, wire transfer withdrawals XTB process in SHA model and it covers full costs charged by Sending Bank.

04

Educational resources, cashback rebates

XTB has an educational centre that is from basic to intermediate and expert levels. Once you select your level you are provided with around a dozen of articles that are built to enhance your trading skills. These articles are often accompanied by video tutorials as well as images so everything is pretty plain and straightforward. XTB also tends to hold live webinars for which you can sign up free of charge.

Cashback rebates are at XTB available exclusively to traders from South Africa (to traders from some other countries they are not available). How much you can earn via the cashback reward system is based on your trading activity. According to the official website of the broker, the exact amount will be agreed between you and your dedicated account manager.

XTB in head-to-head with South African leading competitors

Trading Forex and CFDs entail risk.

Your capital is at risk.

Expert's cricital opinion

XTB has a good international presence, but it was never really that well-known among South African traders. This, however, has started to change after their recent acquisition of the South African FSCA license that enabled them to strengthen their position in South Africa and on the whole African continent.

To establish the quality of the broker's offer, it's important to compare XTB to other colossal Forex Brokers that have the biggest share of the South African Forex market. I believe those are currently Exness and AvaTrade, two big names in the industry.

XTB offers a similar amount of forex pairs like AvaTrade but does not quite catch up to Exness, which has nearly double the amount. However, unlike Exness or AvaTrade, XTB does have a much higher number of all tradable assets. In fact, 10 times more than Exness and 3 times more than AvaTrade. This is mostly due to their extensive offer of stocks.

The minimum deposit at XTB is $1, which is comparable to the minimum deposit at Exness which is $10 and slightly distanced from AvaTrade's min. deposit of $100. Nevertheless, the conditions are still fairly favourable for all brokers.

When looking at the available trading platforms, here XTB does not particularly shine as it offers only its own in-house built platform called xStation. While this platform is very intuitive and user-friendly, Exness and AvaTrade do have the edge here as they both offer MT4 and MT5 which most traders are already familiarised with.

Lastly, one of the biggest concerns of a trader are fees, particularly spreads which are usually the most substantial fees a trader has to encounter. Here, XTB is well positioned as their standard account starts from 0.5 pips on major currency pairs with no commisions paid. This is a bit more competitive than AvaTrade's 0.9 pips but slightly higher than on what Exness attracts its users; 0.3 pips.

Michael Kuchar

CEO of CompareForexBrokers.co.za